Buying a house one spouse bad credit

Currently conventional loans require home buyers to carry a 620 minimum credit score and make a minimum down payment of three percent. Improve your credit score before buying 4.

Married Couple Buying A House Under One Name Do This Upgraded Home

Its important to review different options so you prime yourself for a successful home purchase.

. Exact credit score requirements vary by loan type and lender but the following guidelines will give you a good. Call or text us at 480-721-6253 today. Say your credit score is a 790.

Can I apply for a loan on my own for. When one spouse has bad credit it makes a home loan harder to find. If you can show your partners bad credit stems from factors that will not impact your reasonable ability to repay the home loan the lender may approve a joint application despite a low score.

A score of at least 580 requires a 35 percent down payment while a lower score needs 10 percent down she says. Deciding to apply for a joint mortgage depends on which option will get you the best mortgageOn one hand including the partner. Say your credit score is a 790 which is excellent while your spouses score is not as strong at a 620.

Your spouse essentially borrows another persons stellar credit history and that can bump the low score. How to Buy a Home When One Person Has Bad Credit 29. If one spouse wants to purchase a home for both of the spouses to live in as a primary residence they are able to do so without having the other on the application.

There a several reasons a married couple might want to purchase a home in one spouses name only. What Is the Minimum Credit Score To Buy a Home. Leave Your Spouse Or Partner Off The Loan Having two people on.

I have been married for about one year and we want to buy a condo but my spouse has bad credit that will hold us back on a good loan. New Listing in Last 24 hour Phoenix AZ. Applying for a joint mortgage may seem.

Home mortgage lenders look for couples with regular income and the ability to meet monthly payments. A score of at least 580 requires a 35 percent down payment while a lower score. A 620 is usually the minimum credit score required for a mortgage so in.

If you can make a lump-sum payment to get the utilization below 30 and as. Will my partners bad credit affect me getting a mortgage. Buying a house when one spouse has bad credit requires considerations.

We would love the opportunity to help you find the home of your dreams. Buying a house when one spouse has bad credit requires considerations. 8537 W Roanoke Avenue.

The simple answer is this. Benefits of having only one spouse on the mortgage. Joint mortgage with one bad credit applicant Expert.

While typical down payments range from 35 to 20 of the homes purchase price you may be able to persuade a lender to approve you and your spouse for a mortgage if. Buy during the winter months. My credit is good.

My credit is good. If your partner has a 5000 credit limit and a 4000 balance theyre using 80 of their credit line.

A Pre Pcs Checklist Infographic Pcs Checklist Checklist Moving

Home Home Ownership Home Buying Tips Home Buying

What If My Co Purchaser And I Don T Both Qualify As First Time Homebuyers Ratehub Ca

Guide To Buying A House When One Spouse Has Bad Credit Associates Home Loan Of Florida Inc

One Of The Keys To Making A Smart Choice For Your Family Is Knowing The Local Market To Look At The Current Housing Mar Housing Market Marketing Hampton Roads

Buying A House Without Your Spouse Community Property Edition Quicken Loans

Guide To Buying A House When One Spouse Has Bad Credit Associates Home Loan Of Florida Inc

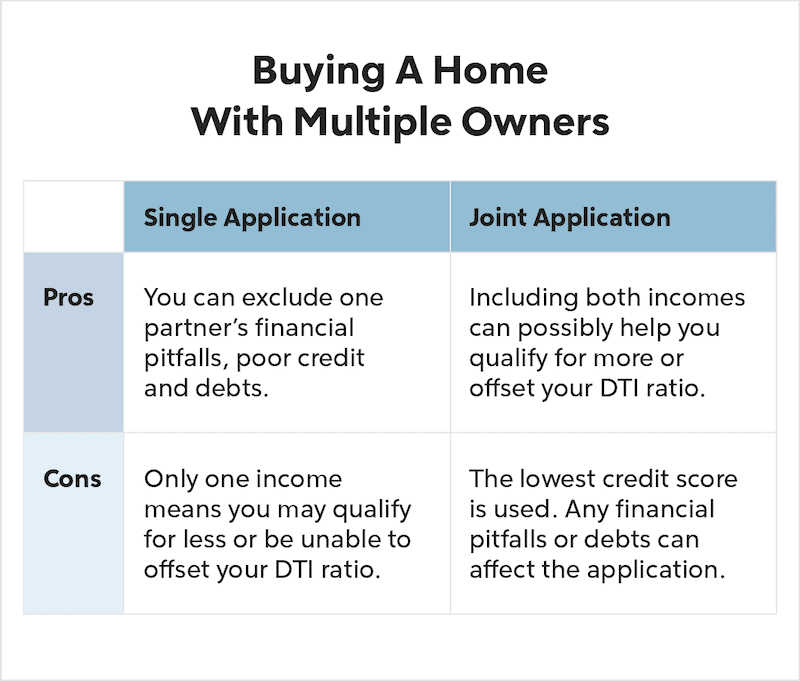

How To Buy A House With Someone You Re Not Married To Experian

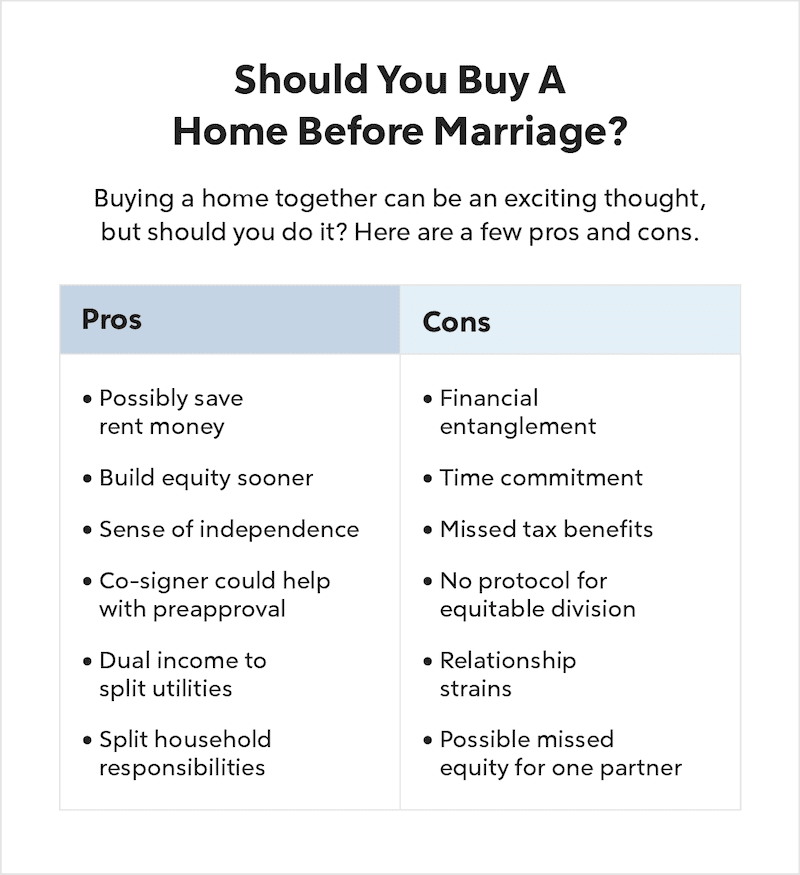

Buying A House Before Marriage Pros And Cons Quicken Loans

Creditcards Creditrestoration Loanservice Creditcard Mortgageservices Mortgagesinflorida Loanspe Credit Repair Services Credit Restoration Credit Repair

How I Got A Credit Score Over 800 And You Can Too Via Karenstl Future Expat Credit Repair Business Credit Repair Credit Repair Services

5 Reasons Not To Buy A House Even If You Qualify For A Va Loan Nextgen Milspouse

June Is Nationalhomeownershipmonth Do You Want To Become A Homeowner But Don T Know What To Do And Whe Home Buying Process Home Ownership Home Buying

Buying A House Without Your Spouse Community Property Edition Quicken Loans

How To Buy A House When Your Spouse Has No Credit Nerdwallet

Does A Non Working Spouse S Credit Affect A Home Loan

Buying A House Before Marriage Pros And Cons Quicken Loans